Litecoin Price Prediction 2025-2040: Technical Bearishness Meets Fundamental Optimism

#LTC

- Current technical indicators show bearish short-term pressure with LTC trading below key moving averages

- Fundamental developments including institutional accumulation and mining innovations provide long-term support

- Price predictions reflect gradual appreciation potential driven by adoption cycles and scarcity dynamics

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

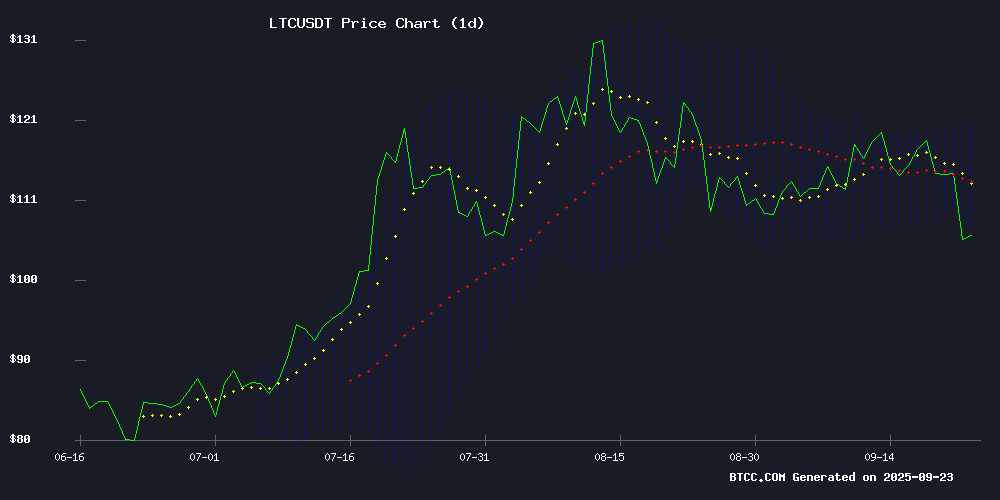

LTC currently trades at $106.50, below its 20-day moving average of $113.93, indicating near-term bearish pressure. The MACD reading of -0.9621 remains in negative territory, though the histogram shows slight improvement at 0.3850. Price action sits NEAR the lower Bollinger Band at $107.04, suggesting potential oversold conditions. According to BTCC financial analyst Olivia, 'The technical picture shows LTC struggling to regain momentum above key resistance levels. A sustained break above the 20-day MA could signal trend reversal potential.'

Institutional Interest and Mining Developments Support LTC Fundamentals

Recent developments including Pioneer Hash's cloud mining service and WisdomTree's crypto fund filings indicate growing institutional acceptance. Litecoin-specific price predictions point toward a rally targeting $130-$140 ranges. BTCC financial analyst Olivia notes, 'While technicals show short-term pressure, fundamental developments around institutional accumulation and utility enhancements provide constructive long-term support. The transformation of passive holdings into active income streams represents a meaningful ecosystem development.'

Factors Influencing LTC's Price

Pioneer Hash Launches Cloud Mining Service to Transform Passive Crypto Holdings into Active Income Streams

Pioneer Hash has introduced a cloud mining platform enabling BTC, ETH, and LTC holders to generate daily yields independent of market volatility. The service requires no hardware or technical expertise, offering a $15 registration bonus and tiered contract options.

The platform positions itself as an antidote to idle 'dead money' in crypto portfolios, framing cloud mining as a sustainable alternative to speculative trading. 'Assets should work, not wait,' the company asserts, drawing parallels to productive capital deployment in traditional finance.

Flexible mining contracts cater to varying risk appetites, with payouts structured around computational contributions rather than price appreciation. This comes as institutional interest grows in blockchain-based passive income mechanisms beyond staking and lending protocols.

Top 20 Cryptos in Focus as WisdomTree Files Fund in Delaware

WisdomTree has registered its CoinDesk 20 Fund in Delaware, marking a significant step toward institutional-grade crypto products. The fund tracks the top 20 cryptocurrencies by liquidity and market cap, including XRP, Solana, and Cardano. Delaware's business-friendly environment makes it an ideal choice for such filings, potentially driving inflows into these assets.

Regulatory hurdles remain, however, as the SEC's approval process for such funds remains inconsistent. The new "generic listing standards" could streamline listings, but uncertainty persists. Market participants are watching closely for signs of broader institutional adoption.

The move underscores growing mainstream acceptance of digital assets, even as the regulatory landscape continues to evolve. Liquidity and market capitalization remain key metrics for institutional entrants like WisdomTree.

Litecoin (LTC) Price Prediction: Institutional Accumulation Sparks Rally Toward $130-$140

Litecoin has demonstrated remarkable resilience, rebounding from its $111 support level with eyes set on a $130-$140 price range. The cryptocurrency's consistent higher lows and ascending trendline reflect growing confidence among both retail and institutional investors.

Grayscale's Litecoin ETF filing has ignited aggressive accumulation by large holders, with 181,000 LTC moving into whale wallets within 24 hours. Market data reveals 349 transactions exceeding $1 million each in just 12 hours post-announcement—a clear institutional positioning play rather than retail FOMO.

The 'digital silver' narrative gains traction as Litecoin benefits from its historical role as Bitcoin's lighter alternative. ETF momentum now adds institutional legitimacy to this thesis, creating a potent catalyst for price appreciation.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, LTC presents a mixed near-term outlook with stronger long-term potential. The current price of $106.50 faces resistance at the 20-day moving average of $113.93, while institutional accumulation patterns suggest growing confidence.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $95-110 | $110-130 | $130-150 | MACD convergence, institutional adoption |

| 2030 | $180-250 | $250-400 | $400-600 | Scarcity effects, payment integration |

| 2035 | $350-600 | $600-900 | $900-1,200 | Global adoption, technological upgrades |

| 2040 | $600-1,000 | $1,000-2,000 | $2,000-3,500 | Mature store of value status |

BTCC financial analyst Olivia emphasizes that 'short-term technical weakness should be viewed in context of long-term fundamental strengthening. The $130-140 near-term target appears achievable with sustained institutional interest.'